This piece is the first of a three-part series, “The launch and strengths of SOMPO Wellbeing.” Please also see parts 2 and 3.

Part 2: A graying Japan’s three concerns and how to ease them

Part 3: Enabling companies to adopt human capital management

From “minimizing loss” to “proactively creating positive value”

A company that has seen its growth built in the insurance industry, the Sompo Group is now placing its wellbeing business at the core of a new management structure. This move comes at the growing need to address what we are calling “three concerns” (health, nursing care, retirement finances) arising from Japan’s low birthrates and aging population.

In Japan, life insurance forms a part of our business portfolio. Traditionally, life insurance is considered a mitigation of risk by “minimizing losses” that result from unfortunate personal events. Wellbeing, in contrast, is about bringing positive value to people’s lives through social, emotional, and even economic wealth.

As people’s needs shift from material comfort to emotional fulfillment and “living well as human beings,” we are redefining our role as a company. Today, we view insurance not only as a safety net, but also as the foundation for a brighter future. This is why we have integrated life insurance and health into a group-wide initiative providing wellbeing services.

New group management structure and launch of SOMPO Wellbeing

In April 2025, Sompo Holdings reorganized its existing businesses into two business segments: SOMPO P&C (property and casualty insurance) and SOMPO Wellbeing (focused on furthering social wellbeing).

SOMPO Wellbeing brings together businesses such as Sompo Himawari Life (domestic life insurance), Sompo Care (nursing care), and Sompo Health Support (lifestyle disease prevention, mental health support, etc). By aligning these organizations and their resources, the aim is to deliver wellbeing directly and holistically.

Inheriting our founding spirit: “Connect and be connected”

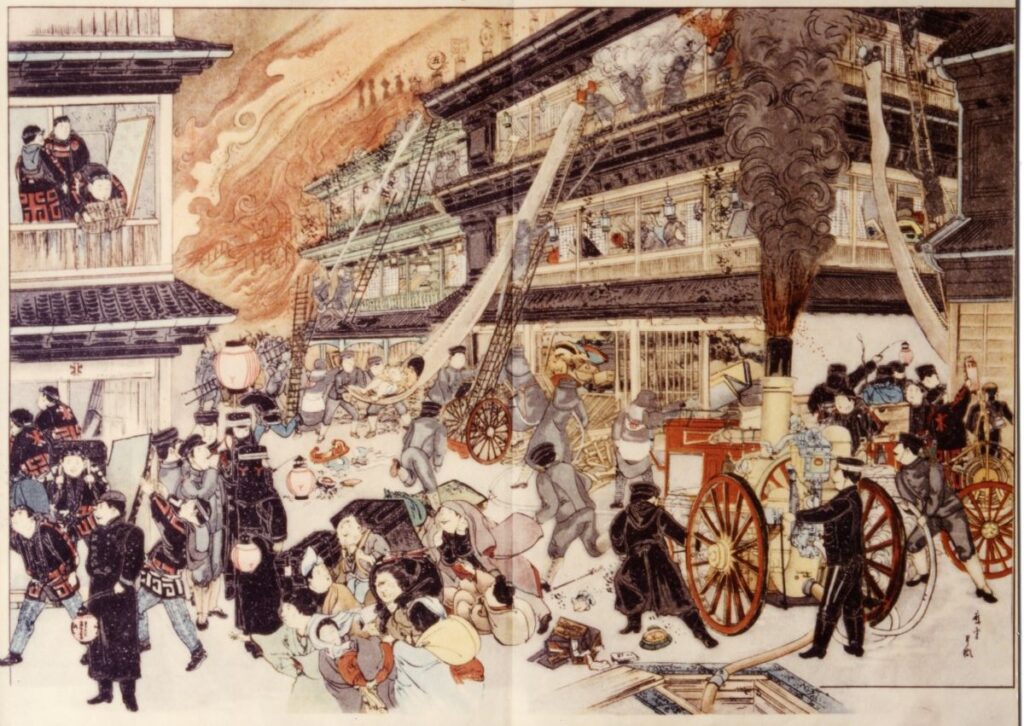

This focused direction is rooted in the Sompo Group’s origins. Back in the day, Tokyo Fire Insurance Company (later Yasuda Fire & Marine Insurance Company, and eventually a part of Sompo Japan) operated its own private firefighting unit, rushing to customers in distress and working to reduce risk. It was a unique model that went beyond insurance payouts to intervention at the source of risk.

When the company was founded in 1888, the average life expectancy in Japan was in the 40s. Today, more than 130 years later, Japan is known for its longevity, a society where both men and women live well past 80. Fire risk has decreased, but new 21st-century risks have emerged.

Inheriting our founding spirit, we arrived at the idea of improving wellbeing to the now longer lives people live.

The key concept that carries forward the spirit of it all, from the time of the private firefighting unit to today’s establishment of the wellbeing business, is “connect and be connected.” Guided by this principle, our businesses collaborate across health, nursing care, and retirement finances to deliver integrated positive value that works effectively to alleviate these three concerns.

This piece is the first of a three-part series, “The launch and strengths of SOMPO Wellbeing.” Please also see parts 2 and 3.

Part 2: A graying Japan’s three concerns and how to ease them

Part 3: Enabling companies to adopt human capital management